I follow a buy and forget type of investment approach i.e. minimum investment horizon of 10 plus years. In this post, using Wonderla Holidays Limited (“Wonderla”) as a case study, I will try to explain the kind of analysis required for such a long term horizon.

Disclaimer: This post is for education purposes only and cannot be construed as recommendation. Please approach your financial advisor for any investment related decisions. I am not SEBI registered RA or RIA. I own the stock discussed here.

Business Model

Understanding the business model is important as it will help us in relating to the numbers in the financial statements of the company. Business model will also help us in making reasonable projections of the company.

Wonderla is one of the largest Amusement Park Chains in India. It presently has three operational parks located at Kochi, Bengaluru and Hyderabad and 1 resort in Bengaluru. Fourth park in Chennai is under construction.

The company originally started its operations in 2000 in Kochi as an amusement water theme park under the name Veegaland. Subsequently, the park was expanded to include land rides.

With the success of the park in Kochi, the company started a new park in Bengaluru in the year 2005. The company expanded the Bengaluru park in 2012 to include a resort with 84 luxury rooms, 30,000 sq.ft. of conference & banquet space, Cricket ground, Badminton court and Sand Volleyball court.

The company went for an IPO to raise funds to the tune of Rs 170 crs to part finance its expansion plans. Accordingly the company set up their third park in Hyderabad which commenced operations in 2016. Fourth park in Chennai is partly constructed. Company expects to complete the construction works in 18 months once the pandemic situation normalises. Company is also exploring an asset light model for its fifth park proposed in Khurda, Odisha.

The company follows a similar template for all its parks. A typical map of its park is as under:

The park is divided into primarily two sections. One section contains land rides and another section contains water rides. Each section comprises three types of rides viz. normal rides, high thrill rides and kids rides. Basically, there are rides to cater to all age groups.

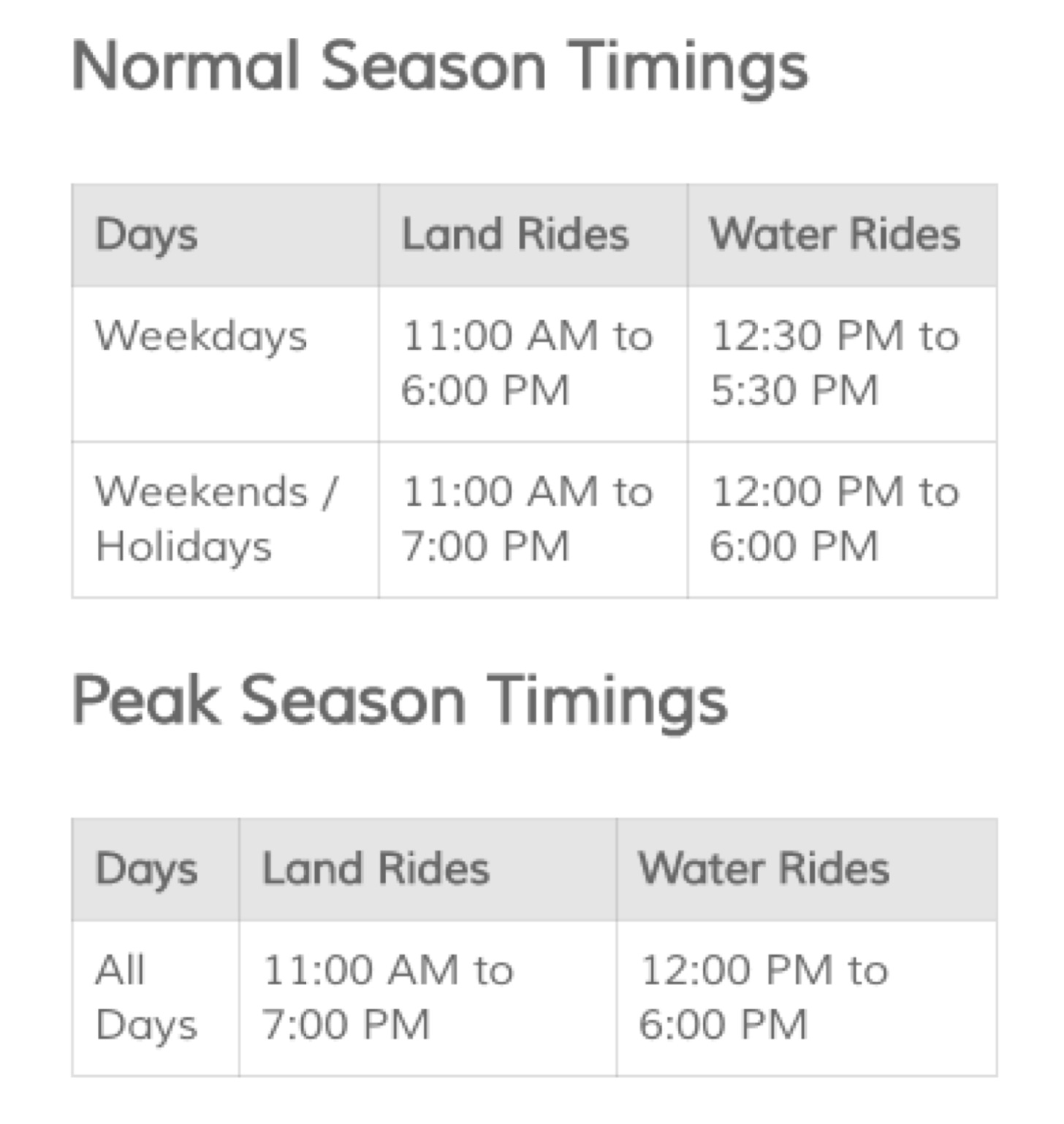

Timings of the park are as under:

All the parks are located on the outskirts of the city. It typically takes 1 to 1.5 hours to reach the parks from the city. Commuting time clubbed with 7 to 8 hours of park timings ensures full day entertainment to the visitors.

The primary revenue source of the company is through entry ticket fee. Ticket fees are different for adults and children. There are two types of tickets, fast track tickets and normal tickets. Fast track ticket is generally twice as costly as a normal ticket. Waiting time for each ride is lesser with a fast track ticket. Ticket prices are also different for weekdays and for weekends and holidays as the demand is higher during weekends and holidays. With the purchase of an entry ticket, a visitor can visit all the rides any number of times during the day.

Each park has various restaurants spread across the park. The cost of food and beverages is not covered in the entry ticket and is to be paid separately. Each park also has locker facilities to store belongings of the visitors the cost of which is over and above the entry ticket.

Downside Protection

Balance sheet analysis

Below is the visual representation of the balance sheet as on March 31, 2020.

We can observe the strength of the Balance Sheet from the following:

The company has not availed any debt to fund its capex or working capital requirements.

87% of the balance sheet is funded through Equity or shareholders money. Since, there is no defined repayment terms for shareholders money, this gives a lot of margin of safety

The company has Rs 121 crs of surplus cash in its books which is another indication of margin of safety

Since the company is into amusement parks, it's a capex intensive business and generally working capital requirements are low. Accordingly, current assets and liabilities primarily comprise tax related entries.

Capital employed in business primarily comprises fixed assets of Rs 831 crs which is 85% of the balance sheet size

We need to dig deeper into fixed assets as they form a major share in the balance sheet. The breakup of fixed assets of Rs 831 crs across various parks is as under:

The company incurred a total capex of Rs 570 Crs in past 10 years viz. Hyderabad park of Rs 250 crs, Chennai park of Rs 109 crs, Bengaluru resort of Rs 26 crs and upgrades of Kochi and Bengaluru parks of Rs 185 Crs. The same is funded to the extent of Rs 170 crs from IPO proceeds. Balance Rs 470 crs was entirely funded through cash accruals.

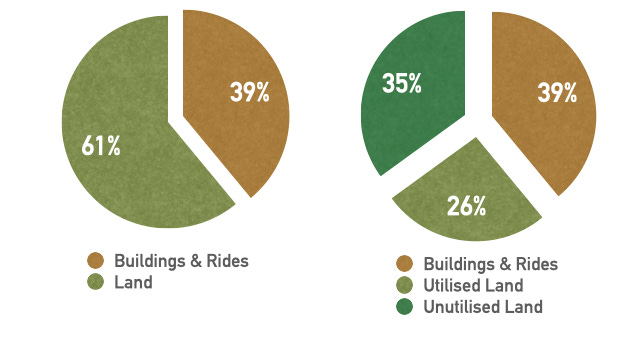

The break up of fixed assets based on nature of fixed asset is as under:

As we can observe, land is a major contribution to fixed assets contributing a share of 61%. Company generally maintains unutilized land in all of its parks for enabling future expansion. Accordingly, unutilised land contributes to about 35% of the fixed assets.

Based on the above analysis, total capital employed in business excluding surplus cash, chennai park and unutilised land is Rs 429 crs.

Profit and Loss analysis

Below is the broad breakup of Profit and Loss statement

Key observations of Profit and Loss statement are as under:

Contribution margin is 90% which is high. Since the company is in the business of amusement parks, the variable expenses are typically low and the majority of the expenses are fixed in nature.

Total fixed expenses of Rs 180 Crs include semi fixed expenses of Rs 100 Crs which consist of majorly salaries, advertising expenses, etc. These semi fixed expenses can be avoided during extreme situations like the present pandemic situation.

Other fixed expenses of Rs 80 crs consist of Rs 40 crs of depreciation which is a non cash item

Based on fixed expenses of Rs 180 crs and contribution margin of 90%, breakeven sales work out to Rs 200 crs which is 71% of 2019 sales indicating sufficient margin of safety.

COVID Impact analysis

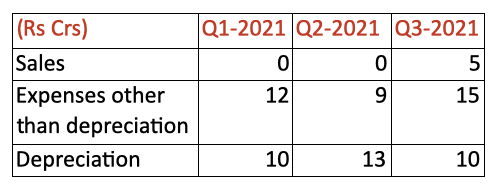

Break up of 9 months quarterly performance during FY2021 is as under:

The quarterly cash burn during pandemic is on an average Rs 12 crs. The company has surplus cash of Rs 121 crs as on March 31, 2020 i.e. start of the pandemic. This surplus cash is sufficient to cover 10 quarters i.e. 30 months of cash burn. The company can further stretch the same by further cutting down expenses which are majority in the form of salaries.

Cash Flow analysis

We need to consider 2019 cash flows instead of 2020 cash flows as there is impact of COVID in Q4-2020 and also impact on cash flows due to one time tax related items.

Cash flow from operations in 2019 is Rs 90 crs. Based on useful life of machinery we can arrive at annual replacement capex requirement of Rs 40 crs. Hence, free cash flows generated by the company works out to Rs 50 crs. Due to high levels of operating leverage, with 10% increase in revenue, the free cash flows will increase by 50% to Rs 75 Crs.

Based on free cash flow of Rs 50 crs, Return on capital employed (ROCE) works out to 12%. With a 10% increase in revenue, ROCE can increase to 18%.

Downside protection on Sales & Profits

We can analyse the downside protection available for revenue and profits using Porter’s five forces model. Porter’s five forces model gives us an idea of sustainable competitive advantage available with the company to protect its sales from declining.

1. Rivalry in Industry:

In Tripadvisor, Wonderla Amusement Park ranks as 3rd best attraction in Benguluru, 6th best attraction in Hyderabad and 5th best attraction in Kochi. Few key observations are as under:

Despite being the newest attraction in Hyderabad, it finds its place in top 10 attractions in the city. All other attractions are more than 20 years old

No similar top attraction in any of the three cities

The other attractions in top 10 in each of the cities are primarily religious places, archeological sites, etc

We can observe that there is hardly any rivalry to Wonderla in this industry

2. Threat of new Entrants

Please find the thoughts of management of Disney with regard to setting up a park in India in this Business Standard article.

“Opening a theme park anywhere in the world is incredibly expensive and is highly complex business. Walt Disney is investing $5 billion in Shanghai in a new theme park, which excludes infrastructure,” Bird said here in an interaction with editors.

“While setting up a park, we have to keep in mind the demand pattern for the next 50 to 75 years as once you open the door to the park, it remains open on all days. Everything, including the infrastructure, has to be in place before opening the doors,” said Bird.

India is still not ready for such a high investment besides the income levels need to reach an inflection point so that the park can sustain guests for the entire year. Theme parks are single largest investments by Walt Disney anywhere in the world and the investment decisions are made after lots of studies and after a gap of over a decade in various locations. Besides, the Disney brand in India still need to grow to see appropriate traction for the park in India, a spokesperson clarified.

Disney invests atleast Rs 25,000 to 35,000 crs in each park as against Rs 350 crs by Wonderla. Due to this Wonderla can achieve breakeven easily and also can price the ticket appropriately. It will take many years before any major foreign player enters India.

If we look at new entrants from domestic players, we can take the example of Adlabs Imagica which is better explained in this Livemint article. Relevant extract of the article is as under:

Mr Manmohan Shetty, Chairman is unable to explain why Imagica did not perform according to plan. He gives the examples of Shanghai Disney Resort, which opened a couple of years ago, Dubai Parks and Resorts and Ocean Park Hong Kong. Neither is a traditional tourist hot spot, but each theme park gets millions of visitors. “Why Hong Kong is doing well and we are not, is anybody’s guess," he whispers.

Shanghai Disney gets about 11 million visitors a year, and Ocean Park around six-seven million, while Imagica is at 1.6 million.

He attempts an explanation, though he admits he does not have all the answers. India has outbound, but not enough inbound, tourists, he says. So while the Imagica founders thought tourists would come from places as varied as Delhi and Dehradun, they found that people could go to Dubai, Hong Kong or Bangkok for a similar price.

“People come to Mumbai for some or the other reason and then see Imagica; they do not come to Mumbai to see Imagica. So we were reduced to visitors from Mumbai, Pune and Gujarat—we have 20% from that state," says Shetty, whose initial estimate was three million visitors a year.

Adlabs Imagica invested nearly Rs 1300 crs in the park which is located midway between Pune and Mumbai. Management expected footfalls of 5 to 6 million per year as against which only 1.6 million visitors ended up visiting. The company is now dragged to bankruptcy.

We can observe from these two examples that this is a very difficult industry to enter. Wonderla mastered the business model wherein it is able to attract the right number of visitors and also generate operating profits for each of its parks.

3. Threat of Substitutes

To better understand substitutes for this Industry, we can refer to Forbes India article on Wonderla.

In a country that has seen middle-class incomes rise, and urban outdoor activities fall, entertainment parks are where families can go for a day of fun. “What do we do when we want to step out of the house? The nearest mall or movie theatre are our limited options,” says Snigdha Sharma, vice president of equities at brokerage firm Axis Capital. “These guys provide that differentiated play when you want to spend an entire day out with a group of friends or family.”

Indians are starved out of entertainment options. We have limited options like restaurants or the nearest mall to visit. Wonderla provides a differentiated entertainment option.

4. Bargaining Power of Buyers

We can again refer to the Forbes India article to understand the bargaining power of buyers.

“From a business perspective, multiple things work for Wonderla: Its pricing is extremely attractive, when compared to Adlabs Imagica; it’s much more affordable to an average middle-class Indian,” says Roy of Edelweiss Financial Services. The average ticket price in Wonderla’s three amusement parks is about ₹1,000 per person for all the rides. At Adlabs Imagica, the ticket prices are split with the water park tickets starting from ₹599, and the theme park tickets starting from ₹999. Food and beverage prices at Wonderla parks are also lower than other entertainment venues like cinema halls.

The one question that Arun gets asked a lot is whether Wonderla Holidays plans to become India’s version of the US’s Disneyland. It doesn’t. “What I admire about Arun is that he knows India is different, and a me-too version of a Western company model will not necessarily work here,” says Sharma. Arun’s idea of Wonderla is to provide an affordable entertainment option for the masses. “If you look at a Disneyland or Universal Studios theme park, it’s a six-day affair and the base fare is close to $300 [₹20,000-plus]. And that’s just for the rides,” Sharma point outs. Add to that the cost of food and beverage and hotel stay, she says. “That kind of price point is no way going to work in a country like India, which is price sensitive.”

Wonderla offers appropriate pricing which is not too expensive to not attract any visitors nor is it too cheap to flood its parks with visitors with over utilisation. At this appropriate pricing it is able to achieve more than break even sales and generate profits. As per earnings call transcripts of Q1-2018, we can further observe this phenomenon wherein pricing of Bengaluru park was increased by 17% which led to decline in footfalls by 3%.

There is price elasticity of demand in this industry which also acts as an advantage to Wonderla as it makes it difficult for competition to enter.

5. Bargaining Power of Suppliers

We can refer to the annual report for FY2020 of the company to understand the bargaining power of suppliers.

Based on the business model we can infer that the two key inputs/purchases for the company are Land and Rides. The company has an in-house manufacturing facility which ensures its cost of procurement of rides is lower as compared to competition.

The company also maintains unutilised land whenever it sets up its parks. This ensures that land is procured at cheaper cost for future expansion. Further, if we assume land costs keep increasing every year, then competition will incur higher costs to set up a new park in the same city as Wonderla park.

State governments across India are supportive of this Industry as it attracts tourism to the state. Odisha Government came forward and requested Wonderla management to setup park in its state. Wonderla is exploring an asset light model to setup park on leasehold land in Odisha.

Summary of Porter’s five forces

Rivalry in Industry

Wonderla parks feature in top 10 attractions in each city it is present in as per Tripadvisor

Threat of New Entrants

Big players unable to enter India due to lack of feasibility

Similar other players went Bankrupt

Difficult business to enter at the price point of Buyers

Threat of substitutes

Limited entertainment options like restaurants and malls

Bargaining Power of Buyers

There is price elasticity of demand. However, price point provided by Wonderla is appropriate to attract enough visitors

Bargaining power of suppliers

In-house manufacturing of rides

Low purchase price of land

Government Support

Management Quality

Wonderla was Founded by Kochouseph Chittilappilly in 2000. It started as an amusement water park under the name Veegaland in Kochi. The name was subsequently changed to Wonderla. Prior to Wonderla, Kochouseph Chittilappilly founded V-Guard Industries Limited in the year 1977. V-Guard Industries has a Market Capitalisation of ~Rs 11,000 Crs as of June 2021. Kochouseph has two sons Arun and Mithun. Mithun looks after V-Guard and Arun heads Wonderla.

How Arun Chittilapilly got into Wonderla can be better understood from the below extract of the Forbes India article.

When Cittilappilly gave Arun an opportunity to start the first Wonderla park in Bengaluru, he happily took it up. Arun candidly admits that he didn’t want to work directly under his father, the man who has become a bit of a legend by starting and building V-Guard Industries, a manufacturer of voltage stabilisers with a market capitalisation of a billion dollars. “I always wanted to do something on my own. I didn’t mind working with dad, but being under him directly would be a little...,” Arun trails off, with a smile. “We are different in our styles. I like to go with the flow whereas for dad everything has to be [done with] clockwork precision.”

We can observe that Arun, who is second generation, is passionate in proving his abilities and accordingly took over operations of Wonderla when it was still only a water park in Kochi instead of a well established V-Guard.

Here is another extract of the Forbes India article.

Arun Chittilappilly loves amusement parks. He makes it a point to go to three or four of them around the world every year. He has his favourite parks—Tokyo DisneySea in Japan, Universal’s Islands of Adventure in Orlando, US, Alton Towers in England, and Europa-Park in Germany—and his favourite rides. “He may well be the only person in India to visit the highest number of amusement parks around the world,” says his father Kochouseph Chittilappilly. And no, that’s not a complaint. For Arun is the 39-year-old managing director of Wonderla Holidays, which runs the Wonderla chain of amusement parks, India’s most profitable company in the sector.

Arun ensures that he visits parks across the world to gain first hand experience to better understand the industry and its evolving trends.

Another relevant extract of the Forbes India article

In 2005, on the outskirts of Bengaluru, Arun opened the gates of Wonderla to visitors, with rides spread across 80 acres. Because of the park’s distance from the city, “We had a house there [in the park] where we lived. We still have the house, but don’t stay there anymore,” says Arun. He started as the executive director of the parent company, Wonderla Holidays, with his father as managing director. He took over his father’s position in a couple of years.

Arun is operationally focused wherein he and his wife stayed in the Bengaluru park itself at the time of construction.

Kochouseph Chittilappilly, father of Arun is the first generation entrepreneur. He is a successful serial entrepreneur wherein he started V-Guard, Wonderla and is also venturing into real estate and NBFC. Few years ago, he redefined the word “charity” by donating his own kidney to a truck driver he do not know.

The mindset of the management is conservative which can be observed from the following actions:

Went for IPO instead debt for Hyderabad Park

There is uninitialised land in each Park for future expansion

Despite having funds tie up, they delayed commencement of Chennai Park as there was delay in approval of LBT waiver by Tamil Nadu Government

Downside Protection - Summary

To summarise we can get downside protection through the following factors:

Strong Balance sheet without any debt and surplus cash

Flexible P/L which can withstand decline in sales and at the same time can boost bottomline due to Operating Leverage

Strong sustainable competitive advantage

Conservative and experienced management

Charitable mindset of management

We can also find downside protection in present valuation wherein setting up a new park takes at least Rs 350 crs. A company with 3 operational amusement parks and 4th partially constructed park is now available at a market capitalisation of Rs 1200 Crs as on June 6th, 2021.

Upside potential

Revenue from New Parks

Management expects to set up a new park every 2 or 3 years. If we assume that within the next 10 to 15 years, there will be atleast 6 parks as against existing 3 parks, there is potential for revenue to double in 10 to 15 years.

The company already commenced work for setting up a park in Chennai wherein it spent Rs 109 crs till date and balance cost to completion is Rs 221 crs. Total budgeted cost for the Park is Rs 330 crs. There is delay in commencing Chennai park due to delay in waiver of LBT by Tamil Nadu Government. Further, ongoing pandemic also delayed the commencement of Park. Total construction time envisaged is 18 months and management proposes to start construction once the pandemic situation normalises.

Odisha Government approached the company for setting up a park in its state. Company is in the process of going for an asset light model at a cost of Rs 107 crs on a leasehold land for its park in Odisha.

The industry market potential is 10 times the present capacity in India as there are only 150 amusement parks for a population of over 130 crs in India as against 400 parks for a population of 30 crs in USA. There is huge scope for growth in industry.

Increase in revenue from hike in ticket price

If we look at the inflation numbers in India for the past few years, it is in the range of 4% since 2015 (which is also one of the lowest periods of inflation). However, inflation reached 12% levels multiple years in the past. Based on these inflation numbers, there is scope for an increase in ticket price by 1.5 to 2 times in the next 10 years which translates to an increase in revenue by 1.5 to 2 times.

With potential increase in disposable incomes of the population and increase in middle class population in the next 10 to 15 years which translates to increase in demand for amusement parks, the company can further increase ticket prices over and above inflation numbers to maintain park utilisation at the same levels. This can lead to another multiplier factor of 2 to 3 times.

Increase in share of non ticketing revenue

Non ticketing revenue is primarily in the form of food and beverages. Presently share of non ticketing revenue is around 30% of total revenue. There is scope for increase of the same to 50% of total revenue inline with other players in entertainment industry.

Wonderla pivoted its food and beverages business model wherein it started food delivery outlets for delivery of food to home through tie up with Swiggy and Zomato.

We can assume another multiplier of 1.20 times increase in revenue on account of increase in non ticketing revenue.

Expansion of existing park

As explained earlier only 45% of land of existing parks is developed. There is scope for development of 55% of the balance land which can generate additional revenue.

Operating leverage

With every percentage increase in revenue, there is scope for 2.5 times increase in profits due to operating leverage available in the company as majority of the expenses are fixed in nature.

Upside Potential - Summary

If we multiply all the factors stated above, there is scope for an increase in sales and profits by 20 times in the next 10 to 15 years. If we assume a terminal PE of 20, then projected market capitalisation can work out to Rs 22,000 crs in next 10 to 15 years as against present market capitalisation of Rs 1,200 crs which can translate to a decent CAGR.

Key Monitoring Parameters

To monitor whether management is able to capitalise on the upside potential, we can monitor the following key parameters every few years:

Increase in Footfalls

Performance of New Parks

Increase in Replacement Capex

Hike in ticket price

If you are interested in fundamental analysis in stock market investing, then why not subscribe to my newsletter. You can expect insightful posts every Sunday like this one by subscribing to this newsletter. Please also share this newsletter with your friends and colleagues as it might benefit them as well.

fantastic analysis, requesting more articles on other contra bets too ...

Very nice posting sir. So deep analysis. I have 50share . So now I will buy on dip