Company Analysis - Balance Sheet Analysis through visual representation

Minimalistic approach to analysis of Balance sheet

Financial statement analysis gives us an idea on past performance of a company. Balance Sheet forms a key part of financial statements of the company. In this post, I’ll analyse a balance sheet through visual representation instead of using typical financial ratios. I developed this method during my decade plus Corporate Banking experience wherein I was required to do credit analysis of various companies. We can easily ascertain the level of margin of safety available to a company through this method.

If we think of a company as a movie, then the Balance sheet represents a single frame in the movie. It gives us a view of a company on a particular date which is generally end of financial year (March 31st for most of the companies in India).

Balance sheet can be better analysed by subdividing into 8 key categories and can be visually represented as under:

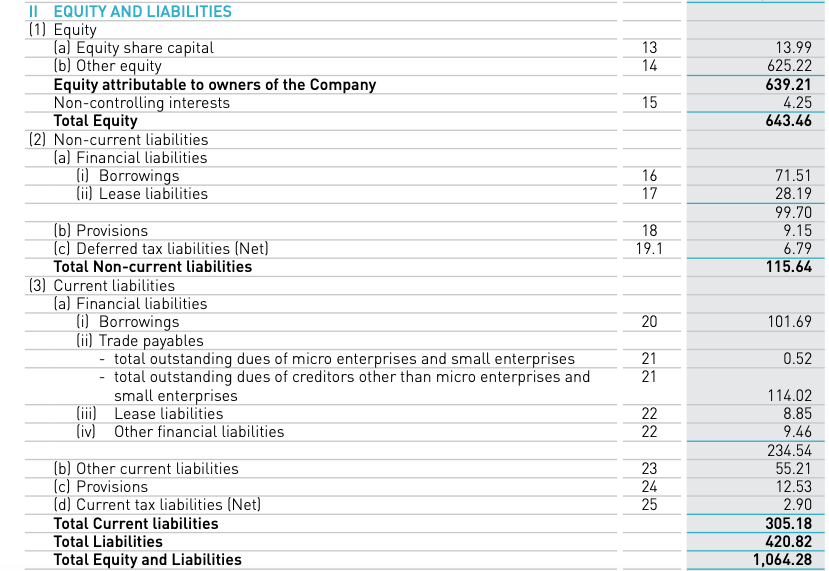

The size of each sub category can be based on the percentage contribution to Asset side/ Liability side of a balance sheet. For example, I have visually plotted balance sheet as on March 31, 2020 of consolidated financials of Symphony Limited as under:

Liabilities or Sources of Funds:

Equity: Equity generally includes paid up share capital, reserves and surplus and other reserves. Share capital is the initial capital brought in by the promoters. Share capital increases with issuance of new shares during IPO or FPO and reduces with purchase of shares during share buybacks. Reserves and surplus is created from retained profits over the years. There are other reserves like share premium reserve which is created if shares are issued in IPO or FPO at a premium to book value i.e. say shares are issued at Rs 70 per share as against book value of Rs 10 per share.

The higher the equity as a % of balance sheet size, the more margin of safety available in the company. The reason being equity is a liability which the company need not pay. There is no stipulated time limit for payment of equity. Equity is repaid to an extent in the form of dividends or share buy back from the profits or surplus cash available in the balance sheet. Equity acts as a margin of safety during tough periods of a company.

When calculating equity we can subtract revaluation reserves from equity and to balance the balance sheet, we can reduce Fixed assets to the same extent. Revaluation reserves are created by revaluing fixed assets of a company wherein fixed assets are increased by considering the present market value instead of depreciated value. This is a non cash item and only a balance sheet entry. This reserve is often created by management to improve financial ratios of the company. To better understand the balance sheet, we need to subtract this reserve and also reduce fixed assets to that extent.

Ideally, for high margin of safety, Equity should be able to fund entire non core assets, fixed assets and a portion of surplus cash or current assets (if surplus cash is not present in the balance sheet).

In the example of Symphony, we can easily realise that there is an adequate margin of safety as equity is funding more than 60% of the balance sheet and is also funding entire non core assets, fixed assets and a portion of surplus cash.

Some companies have negative Equity due to losses over multiple years. Such companies can be considered as low margin of safety companies without requirement of any visual representation

Long Term Debt (LTD) generally comprises loans taken for funding fixed assets. Tenure of these loans is more than one year and can range upto 15 years. While the principal of these loans is paid over a period of time, interest on these loans is required to be serviced every month. Due to this LTD has a bearing on the cash flows of the company during tough times.

There are often other long term liabilities in a balance sheet which are not debt or equity. One such item is deferred tax liability. Other such items are advances paid for capital expenditure, mobilisation advance for long term projects, long term lease obligations, etc. We can club these items with current liabilities to get a conservative view of the company.

Whether to raise Debt for expansion or capital expenditure is the choice of the management. A company can choose to delay expansion by a few years and then fund it entirely through cash generated in business (i.e. retained profits or equity). Generally, companies which have good return on capital employed generate adequate cash flows from operations which can even fund expansion plans. Such companies need not raise any external debt or other sources of funds.

Few companies even go ahead and raise funds through FPO or IPO or other means for funding capital expenditure or expansion plans. Take the example of La Opala as per their Annual Report for FY2015.

The management of La Opala went for Private Placement instead of raising debt to strengthen the balance sheet and raise funds for meeting expansion requirements. By doing so, the company chose to remain debt free and continued to maintain a high level of margin of safety. When the market overvalues a company, then companies can use this approach to raise cheap capital to meet expansion plans.

While Symphony Limited raised Long Term Debt and Short Term Debt, the same is less than surplus cash in the business. Hence net debt is Zero for the company.

We might argue that the cost of debt is less than the cost of equity. While cost of debt is lower and is a cheap source of funds, availing debt also increases risk of ruin and hence thereby reducing the level of margin of safety of a company.

Short term Debt (STD) generally comprises loans taken by a company for working capital purpose i.e. to fund working capital gap in a company. Working capital gap is the difference in current assets and current liabilities. While these loans are revolving in nature and there is no repayment stipulated for these loans, the interest is required to be serviced on a monthly basis.

As explained in Long Term Debt, raising short term debt is also a choice for the management. Companies which can self fund its business requirements through operating cash flows without looking for external sources like Long Term or short term debt have high level of margin of safety.

Current liabilities: Sundry Creditors form a major portion of current liabilities. Sundry creditors are created from the credit period given by suppliers for raw materials purchased by a company. They fund a portion of working capital of a company.

During tough times, companies generally tend to stretch their sundry creditors i.e. delay payments to suppliers. If we observe that sundry creditors are increasing year on year without any increase in sales or current assets, then the company is facing cash flow issues and funding the same by stretching sundry creditors.

Few companies, due to their increasing bargaining power towards their suppliers, can demand higher credit period from their suppliers. In such scenarios, sundry creditors are stretched without any stress in cash flows. We can identify whether a company stretched its creditors due to stress or not by looking at other factors like return on capital employed, surplus cash in balance sheet, debt levels, cash flow from operations, credit rating, etc. I will cover this aspect in detail in a separate post.

Some of the items in current liabilities or long term liabilities can act as a float, i.e. interest free money from other people. One such item is advances from customers. Some companies due to their bargaining power with customers can even attract advances from customers for the goods or services sold by them. Such advances can fund a portion of the balance sheet. Such float can be treated on par with equity. It also indicates there is inherent strength in the business.

Assets or Uses of Funds:

Non Core Assets: There are certain assets in the balance sheet which do not contribute to business operations. These can include unused land bank, closed factory, goodwill, investments & loans and advances to group companies or subsidiaries, etc. These are termed as non core assets. As a thumb rule, these assets should be entirely funded by equity. For a better visual representation of a balance sheet, we need to remove this item from Asset side and also subtract the same from Equity in Liability side (i.e. if Equity is more than non core assets). If Equity is less than Non Core Assets, then it can be concluded that the company has a low margin of safety.

Fixed Assets as per accounting standards are those assets which are required in the business for more than a period of 1 year. I use a different methodology to define Fixed Assets. The assets which are utilised to generate multiple sales i.e. sell multiple goods or services can be defined as Fixed Assets. For example a machine in a factory can be utilised in production of multiple finished goods thereby contributing to sale of multiple goods or services. Whereas a raw material can be used/ or rather consumed in producing a single finished good thereby contributing to only sale of a single good or service. Hence, current assets are those assets which are consumed for contributing to single sale or service like say raw material, work in progress or finished goods.

The level of margin of safety is low in a company if Fixed assets are funded by short term sources like current liability instead of long term sources like Equity or Long Term Debt. In the case of Symphony we observe that entire fixed assets is funded through Equity.

Funding of Fixed Assets through short term sources also indicate less than one current ratio i.e. (current assets plus surplus cash / current liability) < 1.

Reasons why a company ends up with less than 1 current ratio are generally negative in nature. Three primary reasons for the same are as under:

Company stretched its creditors to meet cash flow problems

Company utilised short term sources of funds for long term purposes, resulting in asset liability mismatch

Company incurred losses due to which Equity deteriorated

We might argue that a company due to its bargaining power with suppliers stretched its creditors to an extent that the current liabilities are more than current assets i.e. such companies have negative working capital cycle. However, such companies having negative working capital cycle generally also have surplus cash maintained in their balance sheet which ensures that current assets plus surplus cash / current liabilities is more than 1.

Surplus Cash: Few companies have cash and bank balances and financial investments in their balance sheet which is not required for day to day operations of the company. Such surplus cash acts as a margin of safety during tough times. Symphony Limited has a surplus cash which is 40% of the balance sheet size. The higher the surplus cash the more the margin of safety the company has.

Surplus cash can also be used as an offensive tool during downturns when there are multiple opportunities available for inorganic growth at cheap valuations.

Rajiv Bajaj, MD of Bajaj Auto Limited explains this in article dated June 5, 2015 in economic times titled “Government on right track from a long term perspective: Rajiv Bajaj”

Note: Apple Inc had more than USD 100 billion in surplus cash in its balance sheet at the time of the article.

Current Assets: Current assets as explained above are those assets which are consumed/required for contributing to single sale or service like say raw material, work in progress, finished goods or debtors. If a company does not have surplus cash, then part of the current assets is required to be funded through long term sources of funds to ensure adequate margin of safety. If a company has surplus cash, then surplus cash plus current assets is required to be partly funded through long term sources of funds to ensure adequate margin of safety.

Key Pointers

Key pointers to look at for arriving at level of margin of safety available in a company:

Whether equity is only funding non core assets or; non core assets plus fixed assets or; non core assets plus fixed assets plus a portion of surplus cash/ current assets. The more the Equity funds the asset side of the balance sheet, the higher the margin of safety available

Whether current assets plus surplus cash / current liabilities is more than 1 or less than 1. A ratio of less than 1 indicates low levels of margin of safety

Whether there is any debt in the balance sheet. If yes, then what is the size of debt. Low or zero debt indicated high levels of margin of safety

We can broadly conclude the level of margin of safety available in a company with this visual representation method of the balance sheet.

Few Examples

Below are examples of visual representation of balance sheets of companies falling under various levels of margin of safety i.e. low, moderate & high level of margin of safety.

Thanks Ram.. For the great article.. But where do you get the revaluation reserves?

Superb Ram !!!