Anyone, even those remotely interested in the stock market would have come across the term “Higher the risk, higher the return”. What does this term actually mean?

Higher the Risk, higher the return

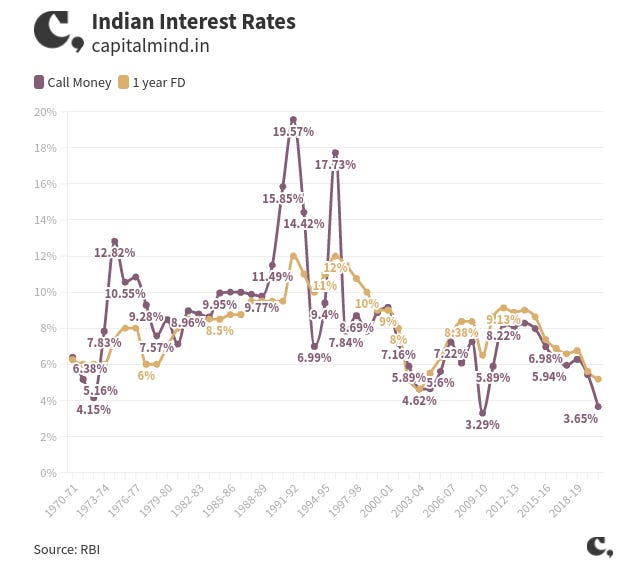

Risk in the above term is defined as volatility of returns. Volatility is further defined as the degree of variation. For example, a Fixed Deposit in a Bank is considered low volatility because returns i.e. interest earned on Fixed deposit (FD) has low degree of variation. In the last 25 years, the lowest 1 year FD rate is in the year 2004 which is 4.6% vs highest rate which is in the year 1996 which is 12%. The degree of change of rate of interest in the past is very low due to which we assume that FDs have low volatility i.e. low risk. If we had invested Rs 1,00,000/- in 1 year FD, then at the end of the year, we might have ended up in the range of Rs 1,04,600/- to Rs 1,12,000/-. Hence, the maximum return we could have earned is Rs 12,000/- and lowest return is Rs 4,600/-.

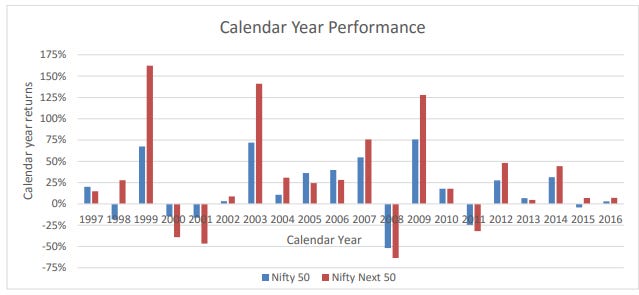

Whereas, the volatility of returns in the stock market is very high. In the last 25 years, the lowest annual return in NIFTY is in 2008 which is -ve 50% vs highest annual return is in 2009 which is +ve 75%. The degree of variation of returns is very high due to which we consider the stock market as high volatility i.e. high risk. If we had invested Rs 1,00,000/- in NIFTY, then at the end of the year, we might have ended up in the range of 50,000/- to Rs 1,75,000/-. Hence, the maximum return we could have earned is Rs 75,000/- and maximum loss is Rs 50,000/-.

FD is a low risk investment in which we could earn a maximum return of Rs 12,000/- in a year. stock market is a high risk investment in which we could have earned a maximum return of Rs 75,000/- in a year.

This explains the phrase “Higher the risk, higher the return”

How is “Risk” misunderstood

There is actually another definition of “Risk” which is more relevant while taking an investing decision. This second definition of Risk is “Probability of loss”.

What is the probability of loss in an FD? At first glance, the probability of loss in an FD might appear to be Zero. But, actually, we might lose money in an FD in the following scenarios:

The Bank in which we open FD goes bankrupt. - Yes Bank saga: Rs 8415 Crs at stake, will AT1 bon holders ever get their money back? AT1 bond holders of Yes Bank, which was sold as Super FD, have not got their money back.

While the gross return on an FD is interest earned. The net or real return on a FD is interest minus inflation. - How FDs give a negative rate of return. Hence, we can actually earn a negative real return on FDs thereby incurring loss.

Interest rate on FD is negative - Negative interest rates explained. In 2014, the European Central Bank (ECB) was the first central bank to adopt a negative interest rate policy, to address the eurozone crisis. The Bank of Japan (BoJ) has been fighting deflation for two decades. It was the first central bank to move to a zero interest policy in 1999, and its key rate has been negative since 2016. Neither the BoJ nor the ECB have been able to move rates back into positive territory.

What is the probability of loss in the stock market? If we go by annual returns of NIFTY, then NIFTY has given negative annual returns in 5 out of the last 25 years. If we instead look at 10 year returns of NIFTY, then it had always given positive returns. Hence, Risk is Zero in the stock market if viewed from a longer term perspective of say more than 10 years. NIFTY has multiplied 17 times in the past 25 years (from 1107 points in 1996 to 17354 points as of Dec 31, 2021) which translates to 12% CAGR.

Whereas the 1 year interest rates on FD fluctuated between 4% to 12% per year. If we adjust the same for inflation, then real returns are much lower. As we have seen, Risk on FD is not Zero.

Hence, by redefining the term Risk, the phrase gets modified as “Lower the Risk, Higher the return”

Lower the Risk, Higher the return

Instead of focusing on volatility, we should instead focus on reducing probability of loss. How do we reduce the probability of loss? There are multiple tools/ways to reduce Risk i.e. the probability of loss in the stock market. Few such tools/ways are explained below:

Time Horizon

As discussed earlier in this post, the probability of loss in the stock market reduces with an increase in time horizon. The longer the tenure of investment in the stock market, the lower the probability of loss.

Diversification

Instead of buying shares of a single company, we can diversify our portfolio, by investing in multiple companies. Negative returns in few companies can be compensated by positive returns in other companies in the portfolio.

We can also think of diversification in terms of time. SIP is a tool for diversifying over time. Market is sometimes undervalued (i.e. bear market) and sometimes overvalued (i.e. bull market). With SIP, we are effectively entering the market at average valuations thereby reducing the probability of loss.

Investing in companies with Zero or near zero debt

Oftentimes, the share price of a company deteriorates if the company goes bankrupt. If a company does not owe any external money (i.e. company with zero or near zero debt), then the chances of a company going bankrupt is also very low.

Investing in companies with Strong Moat or in other words sustainable competitive advantage

If the chances of revenues and profits deteriorating in a company is low, then the chances of share price decreasing also reduces. Companies with strong moat/ sustainable competitive advantages can withstand various external factors to retain their revenue and profit margins.

For example, key raw material for Asian Paints is derived from Crude oil. The company can easily pass on the increase in crude prices to customers by increasing the prices of their products without having any impact on their profit margins or revenues.

Try to avoid investing in companies with shady Management

Oftentimes, returns in a company are compromised, if Management of the company finds ways to not share the earnings of the company with minority shareholders. There are multiple examples where investors lost money by investing in companies with shady management. For example Hinduja Global Solutions hits 20% lower circuit as lower-than-expected dividend disappoints investors

Try to avoid investing in companies which are overvalued

While it is difficult to arrive at the accurate valuation of a company, it is instead relatively easier to identify whether a company is overvalued or undervalued with higher probability. We need to try to invest in companies which are undervalued and try to avoid investing in companies which are overvalued.

For example, the share price of Reliance Industries Limited remained constant at around Rs 500 per share from 2009 till 2017.

But during this period revenues increased by 50% and Profit before tax increased by 40%. Apart from growth in revenue and profits from its core business, the company also invested nearly Rs 1.5 lakh Crores in Jio till 2016 which was yet to contribute to revenues and profits of the company by 2017. Jio started earning significant revenue and profits for the company post 2017.

Despite increase in revenue and profits from 2009 to 2017 and also potential future earnings from investments in Jio, the share price remained constant at Rs 500 per share from 2009 till 2017. The share price subsequently multiplied to nearly 5 times by 2022 from 2017 levels. Trying to invest in companies which are undervalued and avoiding companies which are overvalued reduces probability of loss.

Conclusion

Going to war without shield, sword or training is a high risk situation. Likely returns are low from the same. Whereas, going to war with proper weapons, armory, training and strategy is a low risk and high return situation. Time Horizon, Diversification, SIP, zero debt companies, good management, etc are like sword and shield before entering a war called the stock market.

Trying to understand the definition of risk is the first step in the investment journey.

Quite insightful 👍

Excellent presentation on risk evaluation.