First Pillar of Investing - Avoid Investing in Fragile companies - How to measure fragility in a company using financial statement analysis with Castrol Limited as Case study

In my previous two posts, I introduced the concept of fragility and also explained how to build an Antifragile portfolio. In this post, I will try to explain how to measure the fragility of a company from investors point of view using financial statement analysis using 2 to 3 key ratios.

Annual reports of a company are the primary source where we can get access to financial statements of the company. Screener.in is a very good website which gives a summary of key financials of each and every listed company for the past 10 years. Apart from annual reports, we can also easily download latest rating rationales, announcements of the company, shareholding pattern, etc from the website. We can also create custom ratios, variables and also customize display as per our preferences.

Ill use the method of optionality which I introduced in my previous post for measuring fragility. That method says that more the obligations and lesser the options will increase the fragility of a company.

Financial Statement Analysis

Some of the key ratios which I look at for measuring fragility of a company are:

Equity as a % of Total Liabilities

Equity comprises Equity share capital and Reserves and Surplus. Equity is a liability which a company need not pay. There is no defined timeline for payment of the same. There are stipulated timelines for payment of all other liabilities in a balance sheet except equity. Hence company is not obligated to pay equity. Accordingly, more the Equity as % of Total liabilities, less the obligations of the company to pay and less the fragility of a company.

Lets take the example of Castrol Limited and its balance sheet snapshot from screener.in

Castol’s Equity as a % of total liabilities is consistently above 60%

A company can be considered as not fragile if Equity as a % of Total liabilities is high. As per this ratio, Castrol has very limited obligations to take care off as its Equity as % of Total liabilities has consistently been about 60 to 65%. Accordingly, Castrol does not appear to be fragile as per this ratio

Breakeven Sales as a % of Actual Sales of a company

Break Even sales is the sales at which a company just turns profit. If actual sales turn out to be below breakeven sales, then a company incurs loss. If actual sales turn out to be more than breakeven sales, then the company generates profit.

If actual sales of a company are much higher than breakeven sales, then the company has enough flexibility to experiment wherein the company can afford for a dip in sales without leading to losses. If actual sales are nearly the same as break even sales, then the company has very limited options to experiment as even slight dip in sales will lead to losses. Hence, lower the % of breakeven sales vs Actual Sales, lower the fragility.

If we look at a typical P/L statement, take for example Castrol Limited

Expenses of a company can be bifurcated into Fixed and Variable Expenses. Variable expenses are incurred only if an actual sale is made. Whereas Fixed expenses are incurred whether a company makes a sale or not. Accordingly, fixed expenses are like obligations of a company. More the fixed expenses, more the obligations and more the fragility in the company.

Fixed Expenses by Variable margin gives us breakeven sales. Crude method for arriving at breakeven sales from Screener snapshot is (Interest + Depreciation) by Operating profit margin. Here the assumption is that Fixed expenses of the company comprises only Interest and Depreciation and variable margin is the same as operating margin. However, for deeper analysis, screener snapshot will not suffice as there are other semi fixed expenses like Electricity, Salaries, etc which also needs to be factored in for arriving at Breakeven Sales. You may refer to my detailed post on the same. However, for prima facie analysis screener snapshot will suffice.

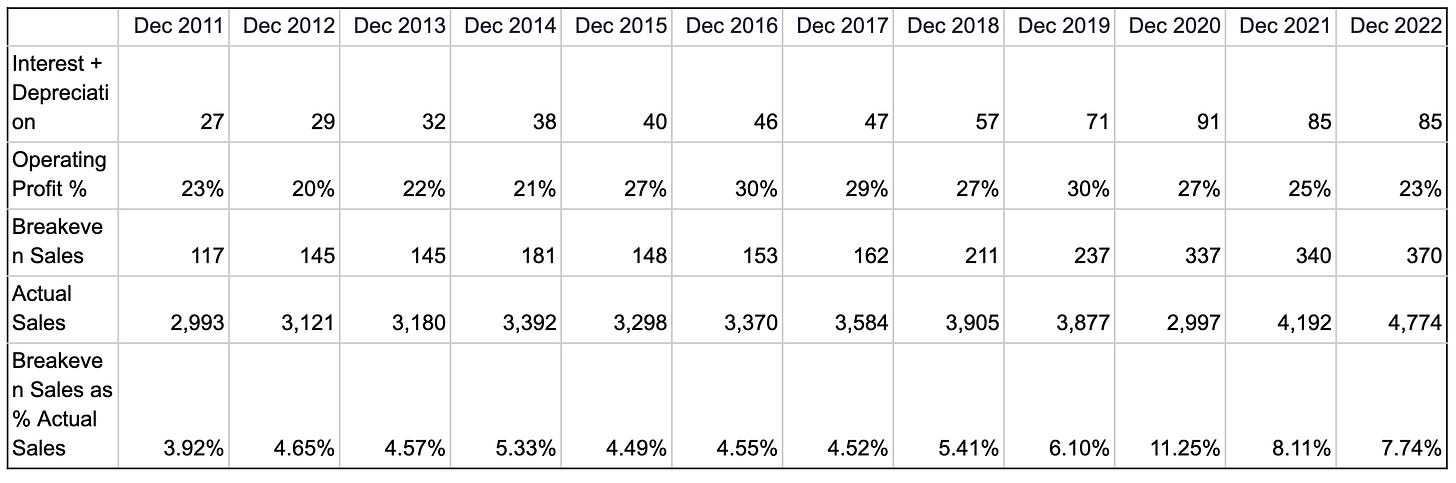

Below is the breakeven sales as a % of actual sales of Castrol Limited.

Breakeven sales as a % of actual sales of Castrol Limited is consistently very low in the range of 4 to 11% for the past 10 years indicating that Castrol has very high flexibility to experiment and very limited obligations (fixed expenses). Accordingly, Castrol Limited is not fragile as per this ratio as well.

Return on Capital Employed (ROCE)

I have written a detailed post on ROCE here. ROCE tells us the return a company generated from its capital employed in business. Its like the rate of interest of a Fixed Deposit. Higher ROCE indicates that there is some inherent strength in the business model of a company. Accordingly, high ROCE indicates that a company is not fragile. For example below is ROCE of Castrol Limited from Screener.

ROCE of Castrol Limited has been consistently above 100% except for the past three years in which case it dipped to 60%. The same may be because of COVID or threat from Electric Vehicles. However, we can come to know of the same only upon deeper analysis of the business model. However, even 60% ROCE is very high as compared to ongoing Fixed Deposit rates of ~7%. Accordingly, we can conclude that the business model of Castrol Limited is nowhere near fragile as of now. However, dip in ROCE in recent years needs to be analyzed further to understand whether there is scope for further dip of ROCE in the future years.

Yearly Debt obligations plus Replacement Capex as a % of Cash Flow from operations

Yearly debt obligations consist of Interest plus Installments. While interest is easily available from P/L statement, one crude way to arrive at Installments is 20% of Borrowings. 20% is based on the assumption that a Debt (Borrowing) needs to be paid in 5 years. One proxy for replacement capex is Depreciation.

Yearly debt obligations and replacement capex are obligations of a company. More the obligations, more the fragility. Accordingly, if obligations as a % of cash flows generated by a company are very low, then we can conclude that the company is not fragile. Further, Cash Flow from operations minus Obligations are surplus cash flows available with the company. Hence very low obligations also imply that the company has surplus cash flows available to utilise for other purposes. This increases the optionality of the company.

Based on these assumptions, following are the calculations for Castrol Limited.

Debt Obligations plus replacement capex as % of Cash Flow from operations for Castrol Limited is consistently in the range of 6 to 11% implying that Castrol Limited is not fragile. Further, it implies that 90% of cash flows generated by Castrol are surplus cash flows. Company is free to utilise these cash flows anywhere it wants like say capacity expansion, Research and Development, New product launches, etc.

In the case of Castrol, the company choose to pay dividends from the majority of the surplus cash flows it generates.

If Castrol had utilized these surplus cash flows for experimentation like capacity expansion, Research and Development, New product launches, etc, it would have turned itself Antifragile. Since, it has been paying back the majority of these cash flows as dividends, it remained as a Robust company. A company can turn from Robust to Antifragile by deploying certain surplus cash flows for experimentation. Few such examples are Reliance Industries which used its surplus cash flows from Oil business for setting up Jio. Another example is Info Edge which uses its surplus cash flows from Naukri to deploy in multiple businesses like Zomato, 99Acres, etc.

Valuation

While above ratios measure fragility of a company, Entry valuation by an investor is an additional variable which increases fragility specific to an investor but does not in any way impact the fragility of a company.

If an investor invests in a Robust or Antifragile company at a very high entry valuation, then the investment becomes fragile even if the company is not fragile as any small bad news will correct the valuations.

Hence, low entry valuation reduces fragility.

One proxy for valuation is P/E (Price to Earnings). However, PEG is a better indicator for valuation as it also incorporates further growth potential of a company into the ratio. In case of Castrol Limited, it is very difficult to gauge the future growth/ cash flows on account of changing industry scenario due to Electric Vehicles. The present PE of Castrol Limited is 13 which indicates that the company will not grow in the future as per present PE. While Castrol's existing business is robust and valuations are reasonable considering healthy dividends from the same, the uncertainties involved are adaptability of Castrol in EV scenario which will have an impact on future earnings. If we assume that EV may not materialize at least for the next 10 years, then the existing entry valuation looks reasonable as we will be able to get 50% payback for our investments in the next 10 years in the form of dividends. Further, if Castrol is able to adopt for EVs, then it will be like an upside.

Disclaimer: This is not a recommendation for investment in Castrol Limited. I gave this example only to explain the concept. You will need to do your own due diligence before investing.

Crisis creates opportunities

On the other hand, bad news for a company creates opportunities for an investor to enter at low valuations. One example is Maggi crisis faced by Nestle in June 2015.

During the Maggi crisis in June 2015, share price of Nestle Limited fell by 20% from Rs 7000 per share to Rs 5500 per share. It further fell to Rs 5000 per share in the year. Maggi contributes only 15% of total sales of the company. However, share price fell 20% indicating that the market assumes the company will no longer be able to sell maggi and also other products of the company will also get impacted. While Nestle recalled its Maggi packets from various dealers and incurred a one time loss of Rs 500 Crs that year. It reintroduced its Maggi product after obtaining required approvals from the government and then the rest is history. Its share price zoomed to present Rs 18000 levels in the next 7 years.

If you are interested in fundamental analysis in stock market investing, then why not subscribe to my newsletter. You can expect periodic insightful posts like this one by subscribing to this newsletter.

Great write up Ram !!

Well explained.