Newton's first law i.e. Law of Inertia states that

“An object at rest remains at rest, or if in motion, remains in motion at a constant velocity unless acted on by a net external force”

In this post, I will try to explain how the stock market follows the Law of Inertia.

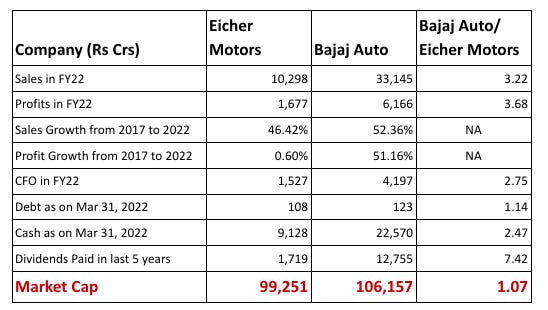

Below is the comparison of 2 companies. Let’s call them Company A and Company B

Both the companies are in the same industry/sector. Management of both companies have shown consistent performance in the many years including the last 5 years which is evident from Sales growth of approx 50% (which includes 2 years of COVID impact).

From the above parameters we can safely assume that Company B can be easily valued atleast 3 times that of Company A.

In the above example, Company A is actually Eicher Motors and Company B is Bajaj Auto Limited. Unlike our expectation of Company B being valued atleast 3 times that of Company A, both the company are valued nearly the same.

Both the companies are primarily into 2 wheelers. Both Rajiv Bajaj, MD of Bajaj Auto and Sidhartha Lal, MD of Eicher Motors have shown exceptional management skills in the past many years. Then why is the market giving both the companies similar valuations when the size of Bajaj Auto is 3 times Eicher Motors?

This anomaly can be explained by going back further 5 years i.e. from 2011 to 2017.

The profits of Eicher Motors grew at a scorching pace during the period 2011 to 2017 as compared to that of Bajaj Auto. However, growth of Bajaj Auto and Eicher Motors remained at similar pace during 2017 to 2022.

Due to this the share price of Bajaj Auto grew gradually during the last 10 years

Whereas share price of Eicher Motors skyrocketed from 2014 to 2017 and then remained flat from 2017 to 2022.

Market still expects Eicher Motors to repeat its high growth performance achieved during 2011 to 2017 as compared to Bajaj Auto even after 5 years. This is the law of inertia into play.

However, the exceptional performance of Eicher Motors achieved during 2011 to 2017 is primarily due to the growth/creation of the premium bike segment wherein Eicher had an edge as it is an existing entrant and capitalised the segment growth. Now Eicher has no longer the edge as it is in a similar mature market as Bajaj Auto. The same is evident from performance during 2017 to 2022.

So while Bajaj Auto should have been valued 3 times Eicher Motors, both companies are instead being given similar valuations.

Conclusion

Market shows inertia in correcting valuations of a company, be it undervaluation or overvaluation. If we can enter an undervalued company and accumulate through SIPs during this inertia period, then we can achieve a high overall CAGR when the market corrects the valuations. Market took time to realise the growth of Eicher Motors due to which price started rising from 2014 when growth started a few years earlier i.e. from 2008. So period of 2008 to 2014 is inertia period.

During the correction period also the market tends to show inertia due to which valuations reach the overvaluation zone from the undervaluation zone. This is what happened with Eicher Motors from 2014 to 2017.

If you are interested in fundamental analysis in stock market investing, then why not subscribe to my newsletter. You can expect periodic insightful posts like this one by subscribing to this newsletter.

good analysing.