Introduction:

In my previous posts in the fragility series which can be found here Fragility Analysis | Budget Tiger (budgetiger.in), we have explored the three fundamental pillars of investing: avoiding investing in fragile companies, steering clear of overvalued companies, and avoiding investing in firms led by management with a fragile mindset. While these principles lay a strong foundation for eliminating fragility in our investments thereby making our portfolio robust/antifragile, let me introduce to the indispensable fourth pillar of investing: Time.

Pillar 4: Time - The Essence of Long-term Investments:

Time plays an undeniably crucial role in investing. It is the secret ingredient that converts our prudent investments into a flourishing portfolio. The longer we allow our investment to stay in the market, the greater the chances for it to grow and flourish. Hence, the adage 'time in the market is better than timing the market' holds truer than ever.

Often, investors are tempted to make quick profits by entering and exiting the market based on short-term trends or speculation. This can increase the fragility of our investments due to volatility, turning the investment game into a gamble. However, true wealth creation requires maturity to allow our investment to marinate in the market for an extended period, often 5 to 10 years, or even longer.

A Statistician's Perspective:

Now, let me try to explain the importance of Time and how it can help reduce fragility by wearing my statistician's hat and dive into some numbers. I have analyzed daily closing index values of NIFTY50 since 1995 i.e. past 28 years data of NIFTY50.

Volatility introduces fragility in our investments. Longer the time frame of our investments lower the volatility. Here is the volatility vs timeframe graph for NIFTY50 index.

As you can observe, volatility of NIFTY50 becomes negligible with longer timeframes like more than 5 years to 10 years.

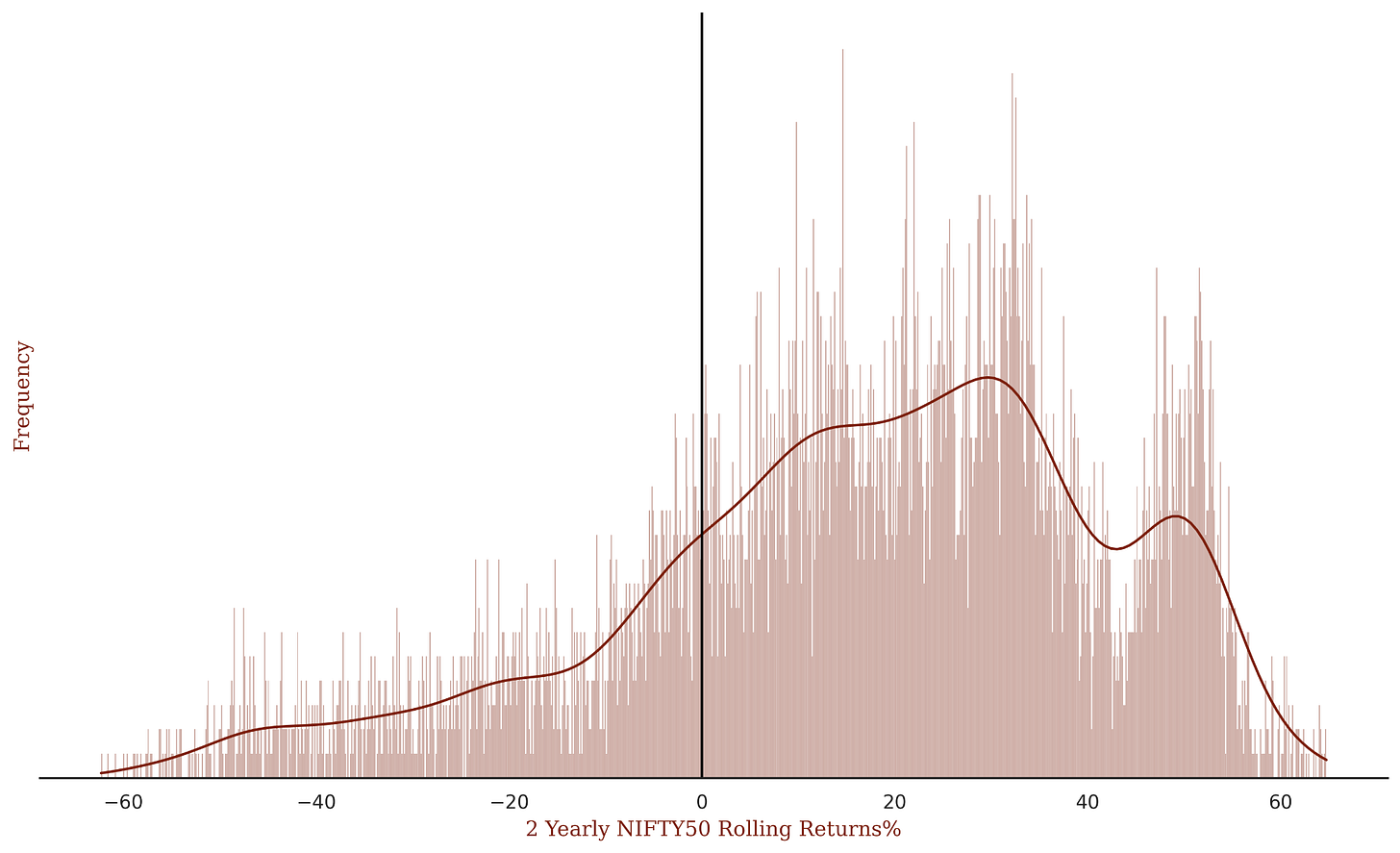

I have plotted % rolling returns of NIFTY50 index of the past 28 years in a histogram for various time frames.

Daily % rolling returns of NIFTY50

Weekly % rolling returns of NIFTY50

Monthly % rolling returns of NIFTY50

Yearly % rolling returns of NIFTY50

2 Yearly % rolling returns of NIFTY50

5 Yearly % rolling returns of NIFTY50

10 Yearly % rolling returns of NIFTY50

As you can observe, when we look at daily returns of NIFTY50, nearly half of the days, NIFTY50 is in losses, whereas NIFTY50 is hardly in losses for a timeframe of 10 years. The histogram moves towards the right side with increasing time frame i.e. the chances of losses reduces with increase in timeframe.

What we can observe from the NIFTY50 data is that volatility is lower for longer timeframes. Further, chances of losses also greatly reduces with longer time frames. Hence, more time we remain invested implies that there is lesser fragility in our investments.

Embracing Windfall gains:

No company, no matter how robust or antifragile, is immune to occasional bouts of bad news. During such times, investments can experience drawdowns, potentially causing momentary panic. However, if we adhere to the first three pillars as explained in my previous posts, our investments will likely be resilient enough to weather these temporary storms of bad news/adverse events without falling into a precipitous decline.

Just as bad news can cause temporary setbacks, good news can bring windfall gains. However, for these windfall gains to blossom and enrich our portfolio, our investments need the fourth Pillar i.e. Time. Staying invested for longer periods allows these positive surprises to compound and significantly boost our returns.

The Value of Contingency Fund:

As you might have understood by now, the longer we remain invested in the stock market, the lesser is the fragility of our investments. Now how do we ensure that our investments stay for a longer period? We ensure this by investing only long term capital in the stock market i.e. we invest money which we don't need in the near/medium term.

This is where the contingency fund helps. Planning ahead for contingencies can make a significant difference in our investment journey. If a financial crunch hits, having a separate contingency fund helps ensure that we do not have to liquidate our long-term equity investments prematurely, especially during a bear market phase. This further underscores the importance of remaining patient and letting time work its magic.

Conclusion:

Ultimately, investing isn't a sprint; it's a marathon. It requires not just smart decision-making but also the patience to stick with those decisions for an extended period. Time, therefore, forms the fourth pillar of investing, supplementing and enhancing the other three pillars.

Just as a sapling requires time to grow into a tall and sturdy tree, our investments need time to transform into a substantial wealth corpus. So, planning our investments wisely, preparing for contingencies, and allowing time to play its magic for financial growth.

If you found this post valuable, please share it with your friends and colleagues who might also benefit from it by asking them to subscribe to my weekly newsletter - weekly posts every Sunday at 8 AM. You can forward this email or click on the social media buttons below. Thank you for reading and subscribing to my newsletter! Your support is greatly appreciated.