Third Pillar of Investing - Avoid investing in companies whose Management has fragile mindset - A Step-by-Step Approach to Management Analysis for Companies

Introduction

There are three key pillars of fundamental analysis in stock market investing.

Pillar 1: Avoiding Investing in fragile companies

We need to try to avoid investing in fragile companies. I explained about the concept of fragility in my previous posts. A fragile company is like a flower vase. We dont know when the flower vase will break or will it even break. We only know that a flower vase is fragile and will break as soon as it falls. By investing in Robust/ Antifragile companies, we avoid this risk. A robust/Antifragile company is like a rubber ball which does not easily break upon a mere fall. I explained about how to measure fragility of a company in my post How to measure fragility in a company using financial statement analysis with Castrol Limited as Case study (budgetiger.in)

Pillar 2: Avoid investing in overvalued companies as overvaluation makes our investment fragile

We need to avoid investing in companies when they are overvalued. Valuation of a company is like a balloon which can burst if there is too much air and on the other hand there is a lot of scope to grow if there is too little air.Valuation is an additional fragility parameter which is relevant for an investor but is irrelevant for a company. Investing in a robust company at overvaluation makes our investment fragile. I explained about overvaluation in my post Overvaluation increases fragility of our investment & Stock Market is not always right (budgetiger.in)

Pillar 3: Avoid investing in companies whose Management has fragile mindset

We can measure the fragility of a company as explained in Pillar 1 by analyzing past financial performance. We can also measure whether a company is overvalued or not as explained in Pillar 2 by conservatively estimating future performance. However, a management with a fragile mindset can hamper future performance of a company. We need to avoid investing in companies whose Management has a fragile mindset. In this post, Ill try to explain how we can analyze whether management of a company has a fragile mindset or not.

Five key qualities of a management with robust/antifragile mindset

If you are into reading books, then The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success by William N. Thorndike Jr. | Goodreads is an excellent book which explains five key qualities of a management with robust/antifragile mindset through eight unconventional CEOs.

Here are are five key skills that the eight unconventional CEOs in the book had:

- They focused on capital allocation as their primary role, rather than operational management or strategic vision. They were able to allocate capital efficiently and effectively among various options such as acquisitions, dividends, share buybacks, debt repayments, or internal investments.

- They had a long-term perspective and did not care about short-term fluctuations in earnings or stock prices. They ignored Wall Street analysts and the media, and did not follow the latest management fads or trends. They were willing to be contrarian and unconventional in their decisions, even if they faced criticism or skepticism from others.

- They had a disciplined approach to valuation and did not overpay for acquisitions or investments. They used simple metrics such as cash flow and return on invested capital to evaluate opportunities, rather than accounting earnings or sales growth. They also avoided diluting their shareholders by issuing new shares or taking on excessive debt.

- They had a decentralized organizational structure and delegated operational authority to their managers. They hired talented and trustworthy people and gave them autonomy and incentives to run their businesses. They did not micromanage or interfere with their managers' decisions, but held them accountable for results.

- They had a frugal mindset and avoided wasteful spending on perks, headquarters, or bureaucracy. They kept their overhead costs low and reinvested their profits into their businesses. They also paid themselves modestly and aligned their interests with their shareholders.

How do we identify if Management of a company has the above qualities? I use the following approach for the same.

Capital Allocation and Disciplines approach

Capital allocation and disciplined approach can be analyzed through the cash flow statement of a company. I explained about Cash Flow Statements in my earlier post Company Analysis - Cash Flow Analysis and their trickle-down effect (budgetiger.in).

Here, lets instead focus on decision making of management through cash flow statement analysis. Below is the summary total of cash flows of TCS for the period FY2019 till FY2023.

Cash flow from Operations indicates the cash generated by the company from its operations. It also includes any cash deployed by company for incremental working capital (WC) requirements i.e. for growth. TCS generated Profits from operations of Rs 2.76,870 Crs in the past 5 years. Out of the same, the company paid taxes of ~Rs 57000 Crs and deployed cash of ~Rs 13000 Crs in WC requirements which is hardly 5% of profits from operations. It is possible that Management is very conservative in investing capital for future growth. This is one of the indicators that Management does not have a fragile mindset. Management with a fragile mindset could have possibly aggressively deployed capital for new projects or acquisitions and could have even taken Debt for the same. For example Meta has burned $15 billion trying to build the metaverse — and nobody's saying exactly where the money went | Business Insider India. This is kind of a fragile mindset. Look what happened after that Meta cuts 11,000 jobs as it sinks more money into the metaverse | Reuters. Let's further go deeper into the Cash flow statements to see what TCS Management did with this surplus cash flow from operations of ~Rs 2,06,000 Crs.

Cash flow from Investing activities indicate whether the company purchased any fixed assets or made any investments. Infact, TCS generated cash of Rs 5,500 Crs from Investing activities. It did not deploy any cash there. TCS purchased Fixed assets worth ~Rs 16,000 Crs which is hardly 7.7% of Cash flow from operations.The same is understandable considering TCS is a services company and would require very little Fixed Assets in commensurate to its operations. TCS invested Rs 6000 Crs in Investments which are mainly Government bonds and Fixed Deposits. IT infact earned Interest of Rs 17000 Crs in past five years on these investments aggregating to ~Rs 50000 Crs. So, where did it deploy the cash generated from business?

Cash Flow from Financing activities is the final item in cash flow statement which indicates how the company raised long term capital if any i.e. through debt or fresh issuance of shares. TCS instead of raising capital, there is outflow of capital to the tune of ~Rs 2,09,000 Crs from financing activities. TCS paid dividends of ~Rs 1,75,000 Crs and Brought back shares of ~Rs 75000 Crs which is nearly Rs 2,00,000 Crs. Management shared the entire cash generated from business operations to shareholders through Dividends or Buyback of shares as it could not find any other growth opportunities. It may be noted that TCS doubled its Sales during this time without requirement for deploying any cash in the business. It also continued to maintain a cash buffer of Rs 50000 Crs in its books.

This indicates that the mindset of TCS management is not fragile. Cash Flow statement analysis helps us analyze capital allocation decisions and whether management has a disciplined approach.

Lets look at another company, Johnson Controls-Hitachi Air Condition India Ltd which is primarily engaged in the business of manufacturing, selling and trading of air conditioners, refrigerators, chillers and VRS systems.

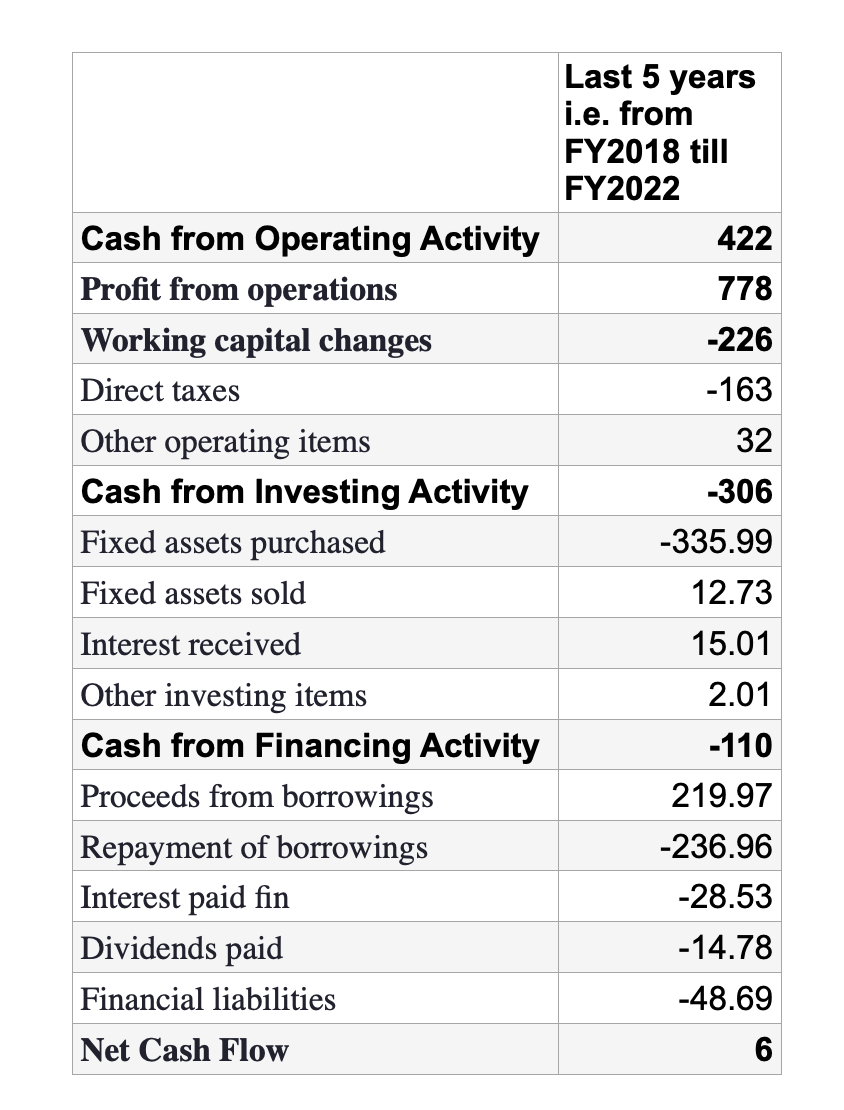

Johnson Control generated profits from operations of Rs 778 Crs and paid taxes of Rs 163 Crs. The company also deployed cash of Rs 226 Crs in incremental WC requirements which is nearly 30% of profit from operations which is slightly bending towards a fragile mindset. Net cash flow from operations is Rs 422 Crs.

The company purchased fixed assets of Rs 336 Crs which is 76% of cash flow from operations. Even if we assume it is difficult to avoid incremental working capital requirements, the management has a choice not to purchase fixed assets except for replacement capex. Infact, the company invested in capacity expansion plans. The company had net fixed assets of only Rs 244 Crs in FY2018 and management invested Rs 336 Crs in Fixed Assets in the next five years. While investing in Capacity expansion plan is not wrong, investing in the same in commensurate with the cash flows generated from operations tells us whether management’s mindset is fragile or not. I feel the mindset of the management in this company is bending towards fragile.

If we look at Cash flow from financing activities, the company raised fresh debt of Rs 220 Crs and paid debt of Rs 236 Cr and it also paid interest on this debt of Rs 29 Crs. The company had debt of only Rs 13 Crs in FY2018. That means, the company raised fresh debt of Rs 220 Crs in the past 5 years and also paid a significant portion of this debt as the company had debt of Rs 112 Crs at the end of March 2022. This shows that the mindset of management is slightly inclined towards fragile.

As we have seen, Cash flow from Investing activities and Financing activities are choices of a management and the way capital is deployed in these activities gives an indication of Management decision making.

Long Term Perspective

Whether Management has a long term perspective or not, we can take cues from the following:

In investor concalls, annual reports and media interviews, we can observe whether management is giving any importance to share price. If managements focus is on long term growth rather than short term stock price valuations, then it indicates that management has long term perspective

For example, ITC’s management did not demerge its various businesses despite a lot of discussions happening by the investors community on the same since the past few years.

MRF Promoters did not split their shares or issue bonus shares despite the share price reaching near Rs 90000 per share. Split of shares or issuance of bonus shares would have decreased the share price, thereby increasing liquidity of the shares in the market. But the Management never thought about the same and instead only focussed on long term growth.They also did not budge despite criticism from the investor community that dividend is only Rs 3 per share on a share price of Rs 90000 per share. The share price of MRF multipled 7.5 times in the last 10 years and turned out to be a wealth creator for the past few decades.

Frugal Mindset

We can take cues from the following on whether Management has Frugal Mindset or not:

Pledge of promoter shares: Borrowing against pledge of shares is the extreme case of borrowing and generally used as a last resort for borrowing when all other options are closed. Pledge of shares by Promoters is a red flag.

No inclination for taking debt

Not investing in swanky offices and spending pattern in personal life

Investing Majority of the profits in business or sharing part the profits with shareholders in the form of dividends or share buyback

Keeping cash buffer in the balance sheet

Alignment of Management's interest with that of minority shareholders

A Management whose interests are not aligned with that of minority shareholders is a red flag. For this red flag. we need to find out if a Management is trying to take out money without sharing with other shareholders. We can take cues from the following for the same:

Salary paid to Promoters/ Management as a % of sales. Ideal scenario is Promoters not taking any salary as they can earn income through dividends. Hence, Salary of promoters as a % of sales is an indication of whether their interests are aligned with that of other shareholders.

Setting up subsidiaries/group companies for backward/forward integration when such businesses can be executed in the same company without forming a new company. We can look at related party transactions for the same in annual report

Issuing warrants to Promoters at a much lower value than the ongoing share price.

Paying royalty to Promoters or related companies. Hindustan Unilever's royalty hike move hits investor mood, stock dips 4% (business-standard.com)

Google search with Management and/or company name along with keywords like fraud, legal disputes, SEBI, etc might reveal something about the management

Skin in the Game

A Promoter who has majority shareholding in a company and the shareholding contributes to the majority portion of networth of the Promoter has lot of skin in the game as compared to a promoter who has less than 50% holding in a company and also the shareholding contributes to only a small portion of net worth. A Promoter who has more skin in the game has more incentive to ensure that the company performs well.

Thank you for reading and subscribing to my newsletter! I hope you found it valuable and informative. If you did, please share it with your friends and colleagues who might also benefit from it. It only takes a few seconds to forward this email or click on the social media buttons below. Your support means a lot to me and helps me reach more people like you.