Fourth Pillar of Investing: Fragility vs. Antifragility: Time's Role in Investment Strategies

As I have informed in my previous post, I had to take 4 to 6 weeks of break in my weekly posts due to personal obligations that required my full attention. I'll try to start posting on a weekly basis again, every Sunday at 8 AM, as I used to do earlier.

I'm back with a new post in the Fragility Series. In my previous posts in the series, I explained about the four pillars of investing. In this post, I would like to give a live example with regard to the fourth pillar of investing, i.e. Time. I gave a detailed explanation about this pillar in my post "Fourth Pillar of Investing: Time – Let’s make it our friend rather than a foe," wherein I explained how fragility reduces with Time; the longer the time horizon of our investments, the lesser the fragility.

Technical Glitch by Zerodha caused losses for a few traders on July 7th, 2023

You can find details of the Technical glitch in the below 2 news articles.

2. Netizens angry after losing money as Zerodha suffers tech glitch again | Mint (livemint.com)

Before we get into the details, we need to understand Equity Options, which is required for better understanding the issue.

Imagine you're planning to buy a new video game console, but you're not sure if you'll have enough money when it's released in three months. You really want to secure the option to buy it at the current price, just in case the price goes up later. So, you decide to pay a small fee to the store owner to lock in that option.

Now, let's translate this concept to the world of finance:

Equity options are like these "price-locking" agreements but for stocks (shares of a company). They give you the right, but not the obligation, to buy or sell a certain number of shares of a company's stock at a set price (called the "strike price") before a specific date (the "expiration date").

There are two types of equity options:

1. Call Option: This is like the price-locking agreement for buying shares. If you buy a call option, you pay a small fee (called the premium) to secure the option to buy the shares at the strike price before the expiration date. If the stock price goes up, you can buy the shares at the lower strike price and sell them at the higher market price, making a profit.

2. Put Option: This is like the price-locking agreement for selling shares. If you buy a put option, you pay a premium to secure the option to sell the shares at the strike price before the expiration date. If the stock price goes down, you can sell the shares at the higher strike price and then buy them back at the lower market price, again making a profit.

Keep in mind that options are time-sensitive, meaning they have an expiration date. If the stock price doesn't move in your favor before the expiration, the option may expire worthless, and you lose the premium you paid for it.

Apart from Options for shares of a company, there are also Index Options, i.e. call/put options for NIFTY or SENSEX.

Now there are few trading strategies that deal with trading Options on their expiry date. As I explained above, Options will become worthless if the price of a company or Index does not move in our favor at the time of expiration, i.e. at 3:30 PM on the expiration date.

A few traders were trading on BSE Options on July 7th, 2023, on the expiry date through Zerodha. They were unable to post their traders on the platform in the last 20 minutes of expiry, i.e. between 3:10 to 3:30 PM, due to which a few of the traders incurred huge losses, which eroded a significant % of their capital.

While it is regrettable that these traders incurred losses due to external factors and not due to their own doing. However, if we think about it, incurring huge losses in our portfolio due to a small technical glitch of a few minutes means the investment strategy is fragile. Fragility means getting significantly impacted by adverse events and antifragility means having minimal impact due to adverse events and taking advantage of positive events. Here, the technical glitch by Zerodha for a few minutes is an adverse event, and this event caused huge losses for a few traders, which implies that the strategy is very fragile. The strategy is overly dependent on the last few minutes of expiry of Options. Those few minutes are very critical for the strategy to work.

This is one of the reasons I prefer a long-term strategy as fragility reduces with time. As I explained in the four pillars of investing in my fragility series, we can eliminate fragility by following the first three pillars of investing, i.e. investing in companies with robust financials, are undervalued, and have management who does not have a fragile mindset. However, the fourth pillar, i.e. Time is equally important. Let me explain this using another example.

Another example with a technical glitch of 2 years!!

Wonderla Holidays is into Amusement Parks. I wrote a detailed post about the company here. The Amusement Parks of the company had to remain closed/ negligible footfalls for 2 full years due to COVID. Try to digest that information, Negligible revenue for 2 full years!!

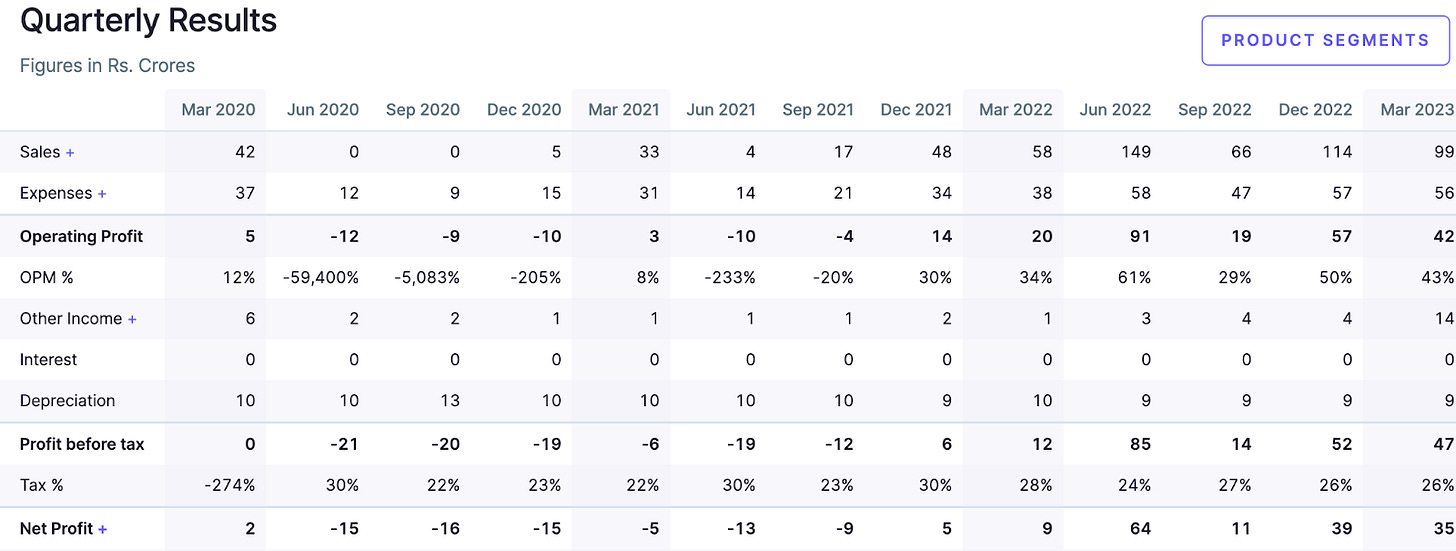

Look at their quarterly results for that period. They had to incur a loss for 6 quarters due to COVID, which is an external adverse event and not because of their own doing. However, they came back strong with lifetime high profits in FY23 after the COVID effect was reduced.

Look at their share price during this period. While the share price fell from Rs 291 in Oct'19 to Rs 110 in May'20, it bounced back and reached an all-time high price of Rs 575 last month.

While COVID is an adverse event, lifetime high profits are partly due to a positive event called revenge tourism. Wonderla was able to absorb a 2-year adverse event and took advantage of a positive event. If this is not antifragile, then what is?

Wonderla was able to survive a technical glitch (COVID lockdown) of 2 full years vs. the traders who could not withstand a technical glitch of a few minutes!!

By looking at the above 2 examples, can’t we safely conclude that Wonderla is antifragile, whereas the trading strategy with regard to Options expiry is fragile?

Our strategy should be such that we can survive adverse events so that we live another day to take advantage of positive events. For this, we need to let the fourth pillar i.e. Time do its work. As they say, Time heals most wounds.

If you found this post valuable, please share it with your friends and colleagues who might also benefit from it by asking them to subscribe to my weekly newsletter - weekly posts every Sunday at 8 AM. You can forward this email or click on the social media buttons below. Thank you for reading and subscribing to my newsletter! Your support is greatly appreciated.