In this post Ill try to explain the step by step approach of fundamental analysis through analysis of Sreeleathers Limited.

Background

Sri Satyabrata Dey wanted to create a durable and affordable footwear Indian brand. His dream gained consumer confidence over the years and Sreeleathers expanded to become a pioneer in Eastern India. Shrimati Shipra Dey joined the business during the formative years of the company to help out Shri Satyabrata Dey. There are 42 stores in 10 states in India. Although Sreeleathers has a limited number of stores, it’s retail performance and popularity make them a formidable footwear brand in the country.

Now we know the business model of the company, lets analyze the company from an investment point of view.

Three pillars of fundamental analysis

As I explained in my earlier posts, there are three pillars of fundamental analysis:

Pillar 1: Avoiding Investing in fragile companies

We need to try to avoid investing in fragile companies. I explained about the concept of fragility in my previous posts. A fragile company is like a flower vase. We dont know when the flower vase will break or will it even break. We only know that a flower vase is fragile and will break as soon as it falls. By investing in Robust/ Antifragile companies, we avoid this risk. A robust/Antifragile company is like a rubber ball which does not easily break upon a mere fall. I explained about how to measure fragility of a company in my post How to measure fragility in a company using financial statement analysis with Castrol Limited as Case study (budgetiger.in)

Pillar 2: Avoid investing in overvalued companies as overvaluation makes our investment fragile

We need to avoid investing in companies when they are overvalued. Valuation of a company is like a balloon which can burst if there is too much air and on the other hand there is a lot of scope to grow if there is too little air.Valuation is an additional fragility parameter which is relevant for an investor but is irrelevant for a company. Investing in a robust company at overvaluation makes our investment fragile. I explained about overvaluation in my post Overvaluation increases fragility of our investment & Stock Market is not always right (budgetiger.in)

Pillar 3: Avoid investing in companies whose Management has fragile mindset

We can measure the fragility of a company as explained in Pillar 1 by analyzing past financial performance. We can also measure whether a company is overvalued or not as explained in Pillar 2 by conservatively estimating future performance. However, a management with a fragile mindset can hamper future performance of a company. We need to avoid investing in companies whose Management has a fragile mindset. In this post, Just as a jockey is crucial for a race horse’s success, the management is vital for a company’s performance. I explained about management analysis in my post A Step-by-Step Approach to Management Analysis for Companies (budgetiger.in)

Ill analyse Sreeleathers Limited through these three pillars

Pillar 1: Avoiding Investing in fragile companies

I have calculated the four key fragility ratios for the past 10 years for Sreeleathers Limited.

Equity as a % of Balance Sheet size

Equity as a % of Balance sheet size has been in the range of 88% to 95% which indicates that the balance sheet of the company is very robust. It also indicates that the Management is very conservative and does not like to take debt.

Breakeven sales as a % of Actual Sales

Breakeven Sales as a % of actual sales has been less than 5% in the past 6 years indicating that the company will continue to generate profits even if sales decline by 95%!!. This ratio indicates that P/L of the company is very robust.

Return on Capital Employed (ROCE)

ROCE fluctuated in the range of 7% to 17% in the past 6 years. ROCE indicates if there is any inherent strength in the business model. ROCE is like interest earned on a Fixed Deposit. Ideally ROCE should be much more than ongoing FD interest rates. However, incase of Sreeleathers, the ROCE during FY2019 and FY2020 is 17% indicating the business model is slightly robust. However, ROCE dipped to 6% during COVID year of FY2021 and increased to 10% which is also the COVID affected year. ROCE however increased to 13.5% if we consider financials upto Sep 2022 financials indicating that dip in ROCE is temporary and only due to COVID disruption, else company’s business model is robust.

Cash flow from operations / (Yearly Debt Obligations + Depreciation)

Cash flow from operations / (Yearly Debt Obligations + Depreciation) indicates the number of times the cash flows generated by a company as compared to fixed obligations of the company like Interest plus installments plus replacement capex. I have used Depreciation as a proxy for replacement capex. The Cash flows from operations has been 5 times fixed obligations since past 6 years indicating that the cash generation of the company is robust.

As per the above analysis we can conclude that the financials of the company is not fragile and instead are very robust.

Pillar 2: Avoid investing in overvalued companies as overvaluation makes our investment fragile

For identifying whether the company is presently overvalued or not, Ill use three ratios PE, 5 year PEG and 10 year PEG ratio.

PE (Price to Earnings)

At the time of writing this post, share price of the company is Rs 188 per share with a market cap of Rs 435 Crs. PAT of FY2022 is Rs 17 Crs indicating a PE of 25.58. If we consider the PAT of last 4 quarters, it is Rs 22.57 Crs indicating a PE of 19.3.

PE of less than 20 generally implies the company is not overvalued. PEG is a better ratio than PE as PEG also factors in growth of the company. High growth companies will command higher PE.

PEG is PE by Growth rate. PEG of near 1 or less indicates that the company is not overvalued.

5 years PEG means PE by CAGR of PAT of past 5 years. 5 year PEG for Sreeleathers Limited is 3.84. This may be partly due to 5th year being FY22 which is a COVID affected year and hence the underperformance in PAT is temporary. PEG will definitely come down with FY23 PAT once the financials results are released as company already generated PAT of 18.88 in 9 months of FY2023 as against full year PAT of Rs 17 Crs in FY2022.

10 years PEG for Sreeleathers Limited is 1.38. PEG of 1.38 even after considering that 10th year is FY22 which is a COVID affected year implies that company is not over valued. PEG will definitely come down if we consider FY23 PAT once released considering 9 months performance.

Company’s market cap is Rs 435 Crs as against cash in books of Rs 200 Crs indicating net market cap is Rs 235 Crs. PE and PEG will be even lower if net market cap is considered.

As per the above ratios, we can conclude that the company is not overvalued.

Pillar 3: Avoid investing in companies whose Management has fragile mindset

We can analyze management decision making through cash flow statement analysis. Here are my observations:

Management has not taken debt in the past 12 years which indicates that they do not have a fragile mindset.

Management Preferred to lease properties instead of purchase of new properties indicating that they have a frugal mindset. Own properties will increase operating leverage as compared to lease properties thereby increasing fragility. Management does not have fragile mindset as per this.

While the company did not pay any dividends with surplus cash generated, management shared part of the profits through Buyback of shares in Nov 2020 to the tune of Rs 33 Crs.

It is very interesting to note that PE is lowest in Nov 2020 in the past 10 years and company initiated buyback at the same time.

This decision alone indicates that management is willing to share wealth with minority holders and also to maximize returns while sharing the same. Dividends would have had tax implications. Buyback of shares will not have tax implications for shareholders who do not tender their shares in buyback. Further, they did not buyback at some random point of time and instead brought back when the company had lowest PE in the past 10 years indicating shares were brought back at the lowest valuation in the past 10 years!! This also indicates that the Management’s thought process is long term and also have a very disciplined approach.

It may be noted that Management tried doing buyback once before in Oct 2017. The share price fell from Rs 300/- levels in 2013 to Rs 130 to Rs 150/- levels in since 2016. Management tried initiating buyback at Rs 156/- per share in Oct 2017. However, the share price started increasing just few days prior to announcement of buyback and never dropped below Rs 156/- until COVID-19 happened. Due to this buyback was unsuccessful in 2017.

Management accumulated surplus cash not required in business to strengthen the balance sheet. At the end of Sep 2022, there is surplus cash of Rs 200 Crs invested in the form of Growth debt mutual funds. Management invested in growth debt funds instead of Fixed Deposits of dividend based Debt Mutual funds which is a tax efficient decision. The company need not show other income unless they sell some mutual fund units unlike incase of Fixed deposit wherein they are required to show other income on interest earned irrespective of whether they utilize the interest/FD or not..

If management wants to increase share price, they can simply sell the accumulated cash reserves of Rs 200 Crs and pay dividends to shareholders. But they are not doing that despite criticism from the investor community and instead focussed on strengthening the balance sheet. They also shared wealth to shareholders at opportune time through buyback at lowest valuation. This shows that Management is not deterred by short term price fluctuations and also has long term focus.

Other checkpoints to see is Management’s interest is aligned with that of minority shareholders

Salary paid to Promoters/ Management as a % of shares.

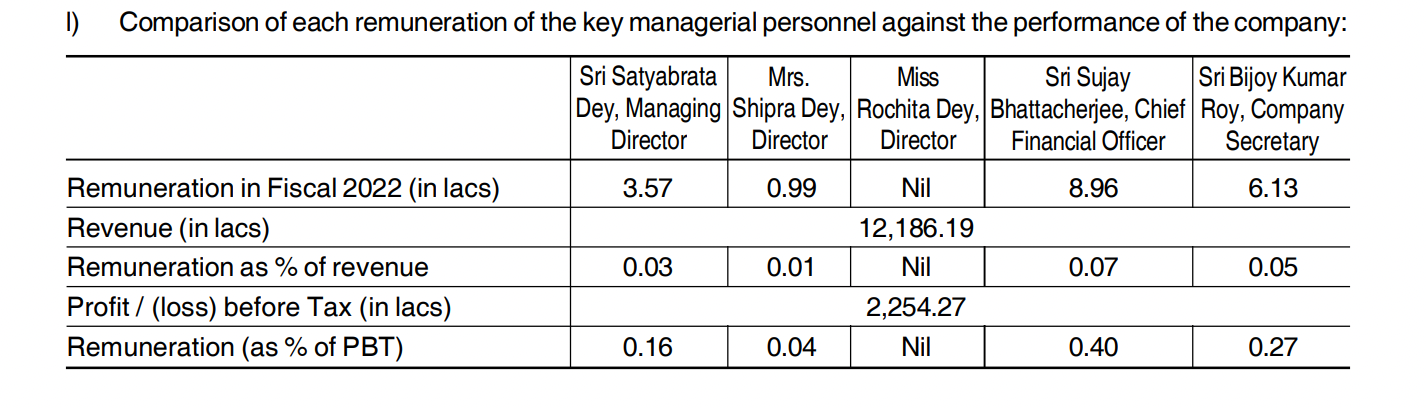

Salary paid to Promoters/Management is very low at Rs 19.65 lakhs in FY22 which is 1.15% of PAT of the company and 0.15% of sales of the company indicating that this is very much within acceptable levels

Below is the related party transactions

The quantum of related party transactions is very low at less than 1% of sales indicating that money is not no scope for diversion of funds if any to other companies.Related party transactions per se is not bad as transactions are done at arm's length basis, but lack of related party transactions means there is not scope for diversion of funds at all.

Management has not been issued warrants till now nor has been paid any royalty. One way of diverting funds is by issuing warrants at lower than market price or promoters paying royalty themselves. That did not happen in Sreeleathers Limited.

Promoter group has been increasing skin in the game as they have increased their shareholding from 66.54% in June 2020 to 75% in March 2023. This indicates that their Skin in the game is increasing.

As per the above analysis, I could not find anything which indicates that Management mindset is fragile.

Few concerns

Management can take the company private. For this there is an elaborate SEBI process and Promoters are required to give open offer to minority shareholders. Investor can decide to exit at that point of time.

What will the management do with surplus cash generated in business? There are multiple options available with the management, they can acquire another company or they can pay huge dividends or they can deploy the same for growth. Management has in the past not shared wealth with shareholders except for the Buyback done in Nov 2020. There are concerns that management may not share these surplus funds with shareholders. May be management has to take more steps to build shareholders confidence. What will the management do with surplus funds is a wait and watch situation.

Conclusion

Financials of Sreeleathers is not fragile. Present Valuation is not fragile. Management does not have a fragile mindset. This makes Sreeleathers Limited a good investment at present valuation for longterm. The concerns raised can be mitigated through portfolio diversification.

Disclaimer: This is not a Buy/sell recommendation. I am not a SEBI registered advisor. I only tried to explain the concept of how to do fundamental analysis.

Thank you for reading and subscribing to my newsletter! I hope you found it valuable and informative. If you did, please share it with your friends and colleagues who might also benefit from it. It only takes a few seconds to forward this email or click on the social media buttons below. Your support means a lot to me and helps me reach more people like you.

Liked the article. Keep writing.

Awesome analysis dude.. very in-depth.